What Credit Score Does Discover Use

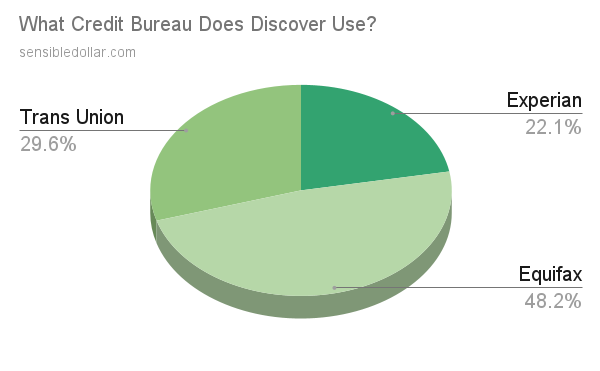

Discover volition almost likely pull your credit study from Equifax with a likelihood of 48.2%, based on historical information information gathered from creditboards.com betwixt 2003 and 2021.

Looking at the pie chart below, there is 29.6% chance that Discover will pull from TransUnion, as opposed to 22.1% from Experian.

These numbers are a reflection of all hard inquiry credit pulls that Discover has performed from all over the United States.

Therefore, information technology may be the case that Discover prefers to pull from one detail bureau that some other on a land by state basis.

The maps beneath evidence the areas in the United States where each credit bureau is primarily being pulled by Find.

United states states where Discover pulls primarily from Equifax

US states where Find pulls primarily from TransUnion

US states where Discover pulls primarily from Experian

It is likewise important to annotation that the information gathered includes pulls:

- associated with applications for credit cards, auto loans, etc

- regardless of whether the application was successful or denied with an adverse action notice

Does Notice pull from the same credit agency for each country?

No, the credit agency from which Discover pulls your credit report is not always the same betwixt states.

Below is a tabular array which breaks down the historical data for each state, providing the likelihood for Discover to pull from each credit bureau.

| State | TransUnion | Experian | Equifax |

|---|---|---|---|

| Alabama | 31.58% | fifteen.79% | 52.63% |

| Alaska | 0.00% | 50.00% | 50.00% |

| Arizona | 8.33% | 25.00% | 66.67% |

| Arkansas | 53.33% | 13.33% | 33.33% |

| California | 27.27% | 17.73% | 55.00% |

| Colorado | twenty.83% | 12.fifty% | 66.67% |

| Connecticut | 36.36% | 22.73% | 40.91% |

| Delaware | 25.00% | 0.00% | 75.00% |

| Florida | 28.46% | 24.62% | 46.92% |

| Georgia | 29.23% | 27.69% | 43.08% |

| Hawaii | 22.22% | 66.67% | 11.11% |

| Idaho | 33.33% | 33.33% | 33.33% |

| Illinois | 31.17% | ten.39% | 58.44% |

| Indiana | 5.56% | 27.78% | 66.67% |

| Iowa | 10.00% | 50.00% | 40.00% |

| Kansas | 25.00% | 33.33% | 41.67% |

| Kentucky | 21.43% | 28.57% | 50.00% |

| Louisiana | 33.33% | viii.33% | 58.33% |

| Maine | 12.l% | 12.fifty% | 75.00% |

| Maryland | 34.48% | 31.03% | 34.48% |

| Massachusetts | 29.03% | 16.13% | 54.84% |

| Michigan | 27.91% | 27.91% | 44.19% |

| Minnesota | 16.67% | 22.22% | 61.11% |

| Mississippi | 40.00% | 30.00% | 30.00% |

| Missouri | 20.83% | 20.83% | 58.33% |

| Montana | 75.00% | 0.00% | 25.00% |

| Nebraska | 33.33% | 50.00% | 16.67% |

| Nevada | five.56% | 22.22% | 72.22% |

| New Hampshire | twenty.00% | 30.00% | 50.00% |

| New Bailiwick of jersey | 18.42% | 23.68% | 57.89% |

| New Mexico | 45.45% | 36.36% | eighteen.xviii% |

| New York | 34.68% | xv.32% | 50.00% |

| North Carolina | 43.xl% | 30.19% | 26.42% |

| North Dakota | 66.67% | 0.00% | 33.33% |

| Ohio | 19.thirty% | 33.33% | 47.37% |

| Oklahoma | 40.00% | 10.00% | 50.00% |

| Oregon | 43.75% | 12.50% | 43.75% |

| Pennsylvania | 35.38% | twenty.00% | 44.62% |

| Rhode Isle | 0.00% | 0.00% | 100.00% |

| South Carolina | 26.67% | sixteen.67% | 56.67% |

| Southward Dakota | 0.00% | 0.00% | 100.00% |

| Tennessee | 55.56% | 22.22% | 22.22% |

| Texas | 27.45% | 22.88% | 49.67% |

| Utah | 30.77% | 15.38% | 53.85% |

| Vermont | 75.00% | 0.00% | 25.00% |

| Virginia | 34.21% | 26.32% | 39.47% |

| Washington | 37.93% | 34.48% | 27.59% |

| Due west Virginia | 40.00% | 0.00% | sixty.00% |

| Wisconsin | 56.00% | 32.00% | 12.00% |

If a item state is non listed, this would mean that there was insufficient data for that state.

The green percent values indicate usa where Discover primarily pulled from 1 particular credit bureau.

Around 62% of states pull primarily from Equifax, despite only 48.2% overall in the United States.

This indicates that there are some states where Experian and TransUnion dominate the residuum of the credit pulls to account for the arrears.

Note that the credit agency from which Detect pulls your credit report will vary depending on the state in which you reside and the credit bill of fare for which you are applying.

Volition Detect always prefer to use ane credit bureau over another?

Yeah, Discover will lean more towards Equifax simply nether half of the time, at 48.ii%.

The information has been gathered from consumers who have practical for credit and have decided to share the information constitute in their credit written report.

Unfortunately, Detect does not disembalm information regarding the credit bureau from which they pull for sure credit card applications.

Therefore, the information provided here should only be used equally an indication of historical credit pulls, and should not be misconstrued as beingness true for all scenarios.

The heatmap below displays the states where Detect has historically pulled from Equifax. The darker colors point larger numbers of credit pulls.

US states where Discover pulls from Equifax the most

Compare this to credit reports pulled from Experian and TransUnion below. What's evident is that the areas covered past all the maps are quite similar, which indicates that Notice still pulls credit reports from Experian and TransUnion for all states, but at slightly smaller numbers.

Us states where Discover pulls from TransUnion the most

Us states where Notice pulls from Experian the most

On the other manus, North Carolina and Wisconsin, both of which have a sample set up of around 30-50 consumers, have indicated that TransUnion is the clear favorite.

Again, the underlying motive for Notice to pull from TransUnion in this case as opposed to Equifax or Experian for these states, is unknown. Perhaps information technology may exist more than cost effective in those cases.

Is there any advantage in knowing which credit bureau Discover uses?

Having prior noesis on the credit agency that Discover uses, volition permit you to focus on improving your credit report for that particular credit bureau.

Mayhap your credit report from all credit bureaus is quite poor and contains derogatory remarks associated with collections, charge-offs, or other delinquencies.

Knowing which credit bureau Notice has a high likelihood of pulling from in your situation, is potentially critical in getting a successful credit application.

In fact, as this commodity has mentioned on numerous occasions, Find volition prefer to pull from Equifax, and so focussing on improving your credit report with them, should be your priority.

However, this is not to say that you lot should ignore your credit reports from other bureaus entirely.

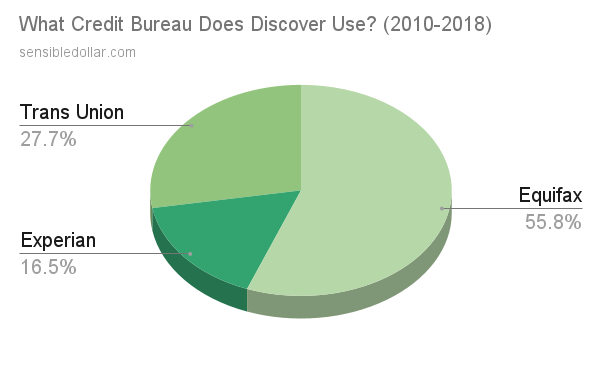

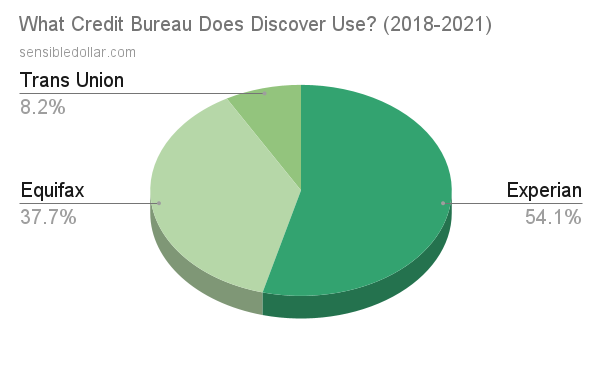

If nosotros compare the years from 2010 to 2018 with 2018 to 2021, the main credit bureau from which Discover would pull credit reports, transitioned from Equifax to Experian.

However, the full number of consumers who reported Equifax as the ascendant credit bureau may still have been overwhelmingly higher to withstand any recent surge from Experian.

Regardless of whether you are applying for credit or non, careful and calculated steps should always exist taken to constantly maintain a potent credit report with all bureaus and to use credit wisely.

What Credit Score Does Discover Use,

Source: https://www.sensibledollar.com/what-credit-bureau-does-discover-use/

Posted by: harriseaut1973.blogspot.com

0 Response to "What Credit Score Does Discover Use"

Post a Comment